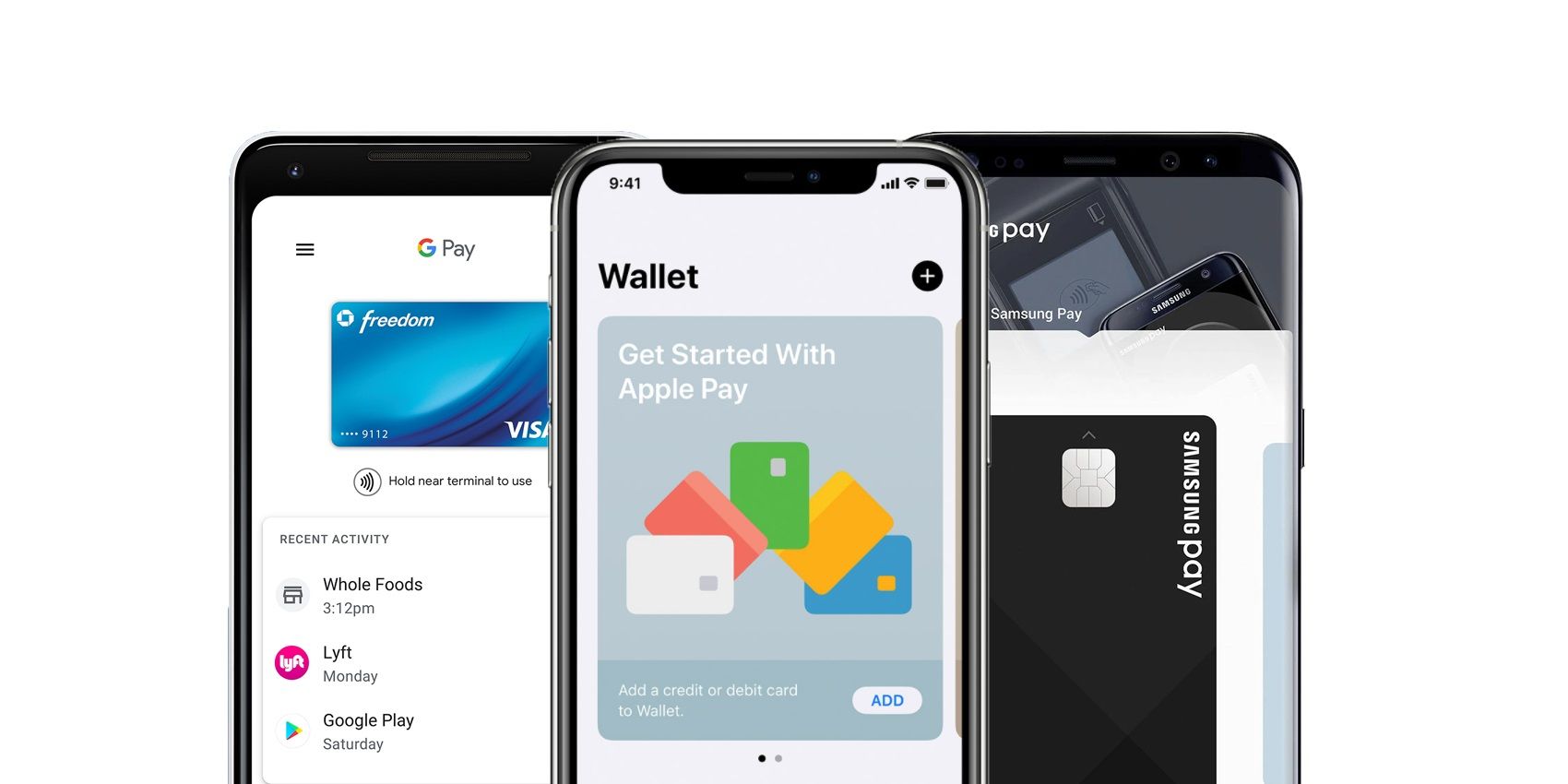

Mobile payments on iOS and Android devices saw a marked increase during the COVID-19 pandemic. Apple Pay on iOS, along with Google Play and Samsung Play on Android, allow phone users to pay for goods and services in the store by holding the device near a payment terminal. These mobile payment methods are not only easy to set up, but are also convenient and now widely accepted.

Apple Pay launched back in 2014. Although limited at the start, support has since expanded. Not to mention, Apple Pay is also available on the Apple Watch. Google Pay, formerly Android Pay, was released in 2015, the same year Samsung Pay was launched. The Google Pay app is available on both Android and iOS, and just like Samsung Pay, includes a wide range of useful features. However, one of the main differences with Samsung Pay is its support for MST in addition to NFC.

According to eMarketer, in-store mobile payment methods will reach 101.2 million people this year, a new record. The reason for the growth was the higher number of people looking for a contact-free payment method during the pandemic. The data also suggests that a significant percentage of new users were Millennials and Generation Z. Furthermore, eMarketer expects the number of new users to continue to increase by an addition 6.5 million each year between 2021 and 2025. All of which will also continue to result in an increase in spending as well. For example, eMarketer expects a 23.6-percent increase in average annual spend this year, from roughly $1973 in 2020 to $2,439.69 in 2021, with spending likely to surpass $3,000 by 2023 and $4,000 by 2025.

According to the report, Apple Pay is the market leader in the United States with 43.9 million users having made a payment within the last six moths. In addition, Apple Pay is projected to add 14.4 million new users during the next few years. In third place, after the Starbucks mobile app, is Google Pay with 25 million users and the expectation of an additional 10.2 million by 2025. Meanwhile, Samsung Pay apparently won’t grow quite as much as the others. In addition to the 16.3 million that have used the mobile payment solution in the U.S. in recent months, Samsung Pay is projected to only add two million more by 2025.

Even with the COVID-19 vaccine now available and lockdown measures expected to continue to be eased over the coming months, mobile payment methods will likely continue to see an increase in use. Along with being contactless and convenient, they also offer more security, even if the user loses their phone. For example, Apple Pay requires the use of Face ID or a passcode to work.

Source: eMarketer

from ScreenRant - Feed https://ift.tt/39JcS8z

0 Comments